AI Risk Detective

for Auto Lenders

-

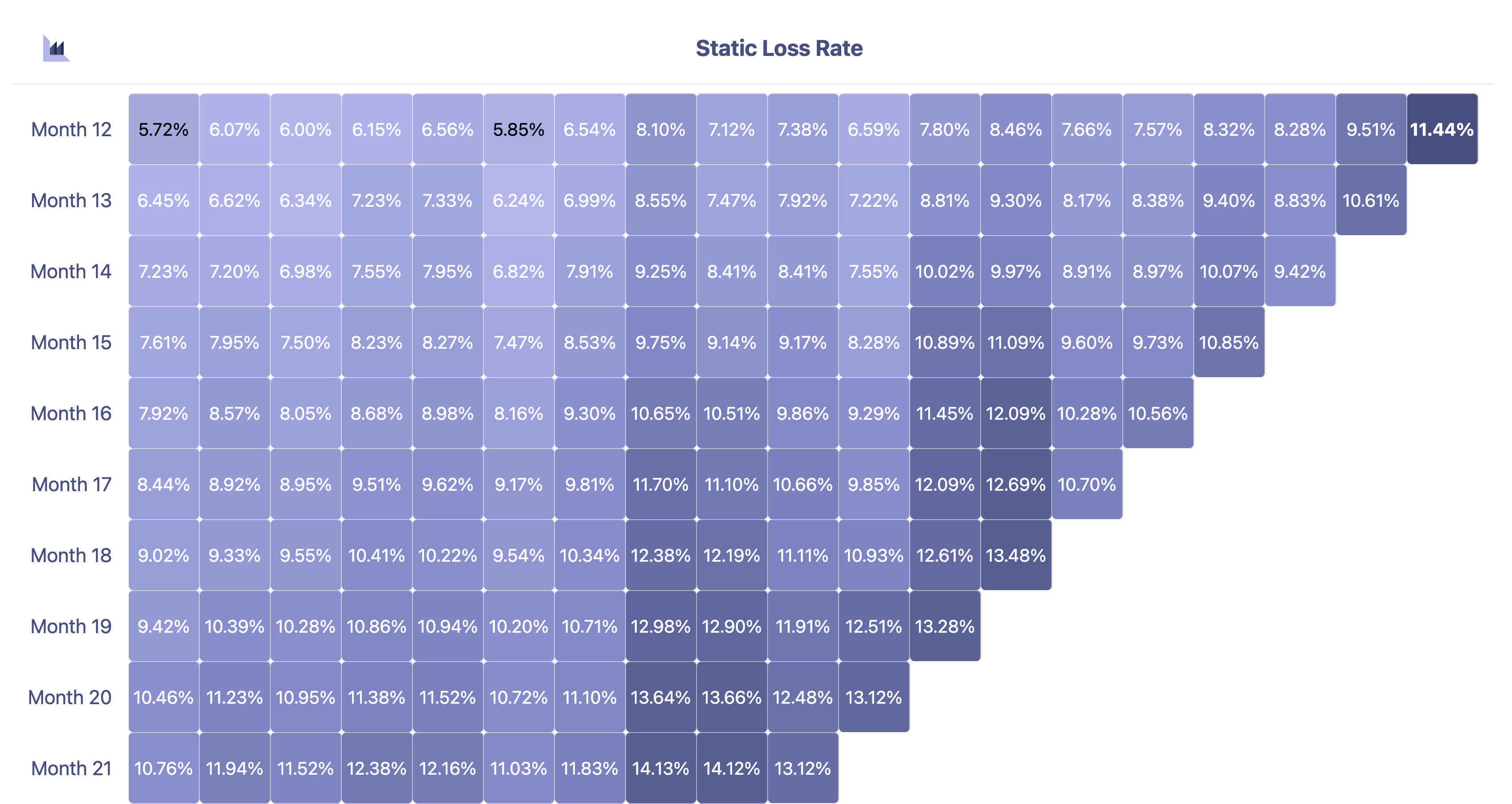

Charge-offs spike in hidden micro-segments but topline KPIs appear stable

-

Shifts in car prices, tariff changes, and interest rate volatility ripple through select borrower tiers

-

High-risk borrower profiles and underperforming dealers blend into portfolio averages

From Charge-Offs to Root Cause in One Click

-

Automatically identifies risk factors in your portfolio

-

Analyzes external factors affecting loan performance

-

Curated recommendations are delivered to your inbox

Solving the Combinatorial Explosion in Risk Assessment

Built for Leaders Driving Risk and Revenue

A clear, predictive view of portfolio health

See emerging risks before they hit top-line KPIs. Weekly executive briefs highlight where yield is threatened and where to lean in.

Surface micro-segments driving losses

Connect loan performance with external signals to identify mispriced segments before losses materialize.

Balance growth with portfolio protection

Know when to push volume and when to pull back. Align dealer strategy with risk signals to drive profitable growth — week after week.

What our customers have to say

"My week begins in DataScoop. It informs me of important changes to my business, and improves my time spent on dashboards. It proactively uncovers trends and problems that would otherwise catch us off guard. My team looks forward to DataScoop narrative every Monday morning."

"DataScoop uses comprehensive data collection and analysis methodologies to effectively direct towards the root causes related to a business problem. The visualization towards isolating the problem to specific segments is well-structured and is powerful in drawing insights from metrics trends and doing targeted study. The tool also follows a thorough stakeholder involvement process and considers any user input relevant for analysis/insights. Overall, I would recommend DataScoop for business users tracking KPIs/business metrics trends on a regular basis."

"DataScoop diagnoses metric deviations comprehensively, going beyond traditional tools. It synthesizes external data (macroeconomic indicators) to contextualize metric shifts and presents complex insights as readable narratives. If analyzing a business metric is a 100-mile journey, this tool covers the first 50 miles effortlessly, allowing analysts to focus on deeper, strategic insights. Leveraging recent AI advancements, DataScoop represents the future of analytics."

Data Privacy and Security

Also available in: